The Investor Plan

The Investor Plan

Create a core portfolio and learn how to use strategic investing strategies

The Investor Plan

The Investor PlanCreate a core portfolio and learn how to use strategic investing strategies

Take our top eight investing courses and build a strategic portfolio.

Run our prebuilt screens to find great new stock investing ideas daily.

Search more than 600 webinars to learn new trading techniques.

New trading ideas and fundamental screener updates sent daily.

All content is now FREE!

Questions we consider in this first course: How diversified is your portfolio? Is your portfolio protected from the downside shocks that may hit it in the future? If you don't own stocks, bonds, commodities, real estate, precious metals and a little cash, you aren't nearly diversified enough.

The following comprehensive lessons are included in this course:

Every strategic portfolio needs a solid base. The strength of your base will determine just how successful your portfolio is going to be. One of the easiest ways to build a solid base is to use exchange-traded funds (ETFs). ETFs put the power of diversification and cost control in the palm of your hand. Plus, thanks to the explosion of these funds in the industry, you can find an ETF for just about anything these days.

This course teaches you how to find stock and bond funds. We also explore other ways to diversify your portfolio, such as through real estate, commodity and even cash funds.

The following comprehensive lessons are included in this course:

Individual equities, because they don't provide instant diversification, typically have more upside potential than ETFs. Of course, that increased potential comes with increased risk as well, but if you're looking for growth, individual equities can work well for you — as long as you know what you're doing. This course will teach you how to analyze revenue and earnings per share, ways to assess management performance and understanding how Wall Street evaluates and affects stock prices. We finish with a review of relative strength and sector (or "top down") analysis.

The following comprehensive lessons are included in this course:

Once you have built your base, this course helps you understand how to manage your base. In this course we cover position sizing, stop loss orders, scheduled rebalancing and dollar cost average. All great ways to tend to your investing garden.

Diversification doesn't do you much good unless your money is thoughtfully distributed across those various investments. Putting 90 percent of your money in one investment and the other 10 percent in your remaining investments won't do you much good. We start this course by helping you understand the benefits of position sizing.

The following comprehensive lessons are included in this course:

Once you have established a strong foundation for your portfolio, you can start to put it to work for you with dividend payments. Whether you are looking to fund your retirement, pay for a child's education or simply provide a little extra spending cash, dividends provide great way to generate income. This course helps investors understand dividend yields, how to search for dividends and when to combine dividends with your growth strategy.

The following comprehensive lessons are included in this course:

If you’ve never traded options before and don’t know much about them, this course will be a great introduction for you. Options are a highly effective trading tool that provide a tremendous amount of flexibility and opportunity for your portfolio... if you know how to use them appropriately. That's why it's important for us to learn how options are created and the difference between a call option and a put option. we also cover how to determine how 'risky' an option is, what is driving the value of the option and how to read an option chain sheet.

The following comprehensive lessons are included in this course:

This course starts with a review the basics of long call and put options to ensure you can make well-informed trading decisions. We make sure you understand how to determine your strike prices and exercise dates for various long call or long put buying decisions. By the end of the course you'll be posting option trading ideas for your instructor to review.

The following comprehensive lessons are included in this course:

Sometimes the best way to accelerate portfolio growth is to prevent losses from occurring in the first place. So how do you protect positions in your portfolio using options? The answer: you buy protective puts. In this course we learn how to buy protective puts and, much like the last course on put and call options, we talk about choosing expiration dates and strike prices that are optimal for your strategy. By the end of the course you will be expected to publish a protective put trade idea either for your instructor or for the community.

The following comprehensive lessons are included in this course:

When we wanted to search for stocks we were frustrated that no screening tool offered what we were looking for. So we built our own. Finally, a tool that helps you find good trading opportunities every day.

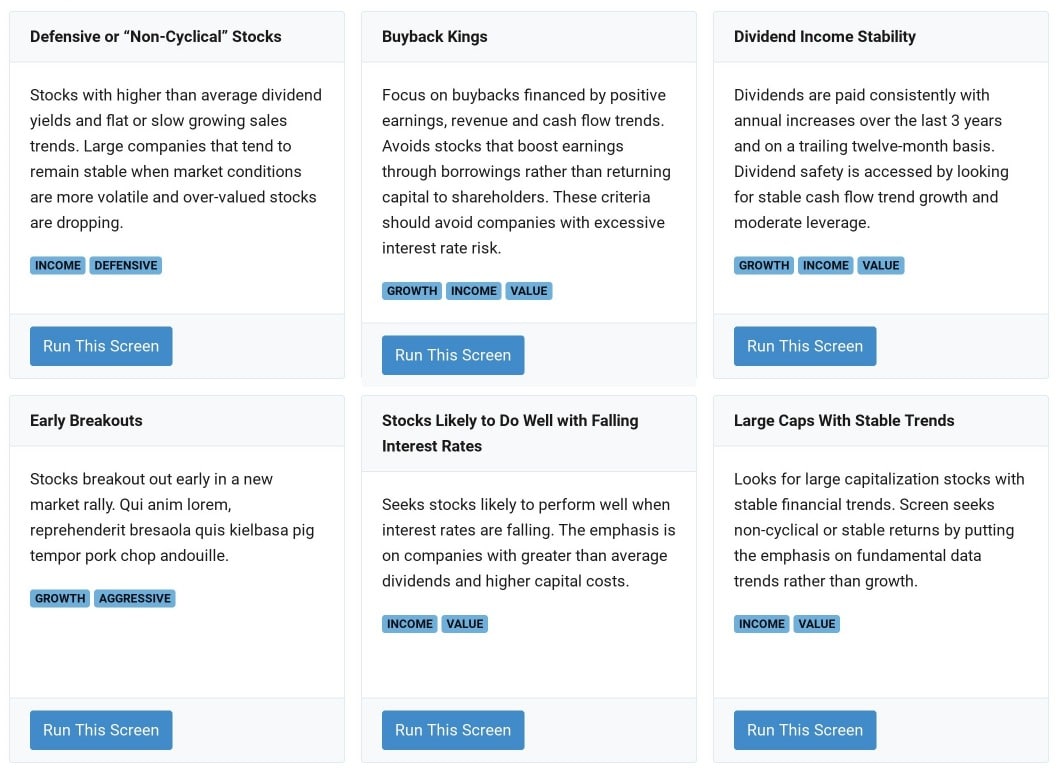

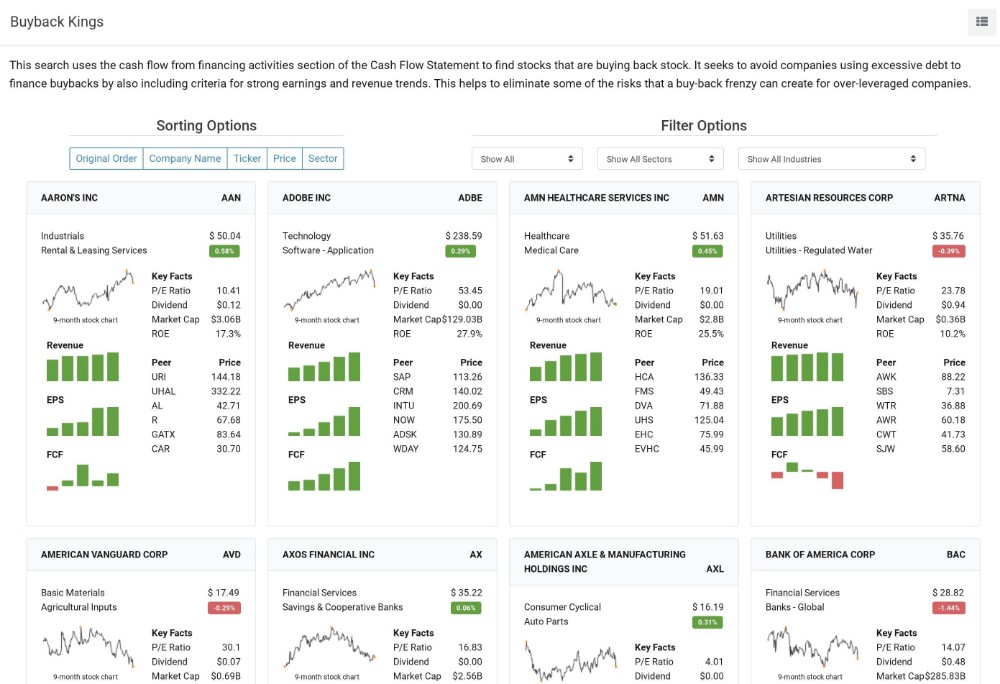

Our top analysts create prebuilt stocks screens just for you. All you have to do is push a button to find "Buyback Kings," or "Stocks Likely to Do Well with Falling Interest Rates," or "Small Caps on the Rise."

| Each recorded webinar is about 60-minutes with Q&A | Included? |

|---|---|

| Building a Long-Short Portfolio Strategy | |

| Identifying Price Targets with the RSI | |

| Fine Tuning the Volume on Price Indicator | |

| Building Technical Trading Systems | |

| Identifying Lows and Highs | |

| Sector Rotation and the Business Cycle | |

| Adjusting Expectations with the Average Directional Index (ADX) | |

| Bonds vs. Bond ETFs – What You Don’t Know Can Hurt You | |

| Applying Indicators to Indicators | |

| The Magic of Multiple Charting Time Frames | |

| Choosing the Best Oscillating Indicator for Your Charts | |

| Reading the Commitment of Traders (COT) Report | |

| The Ins and Outs of the Gold Market and Gold ETFs | |

| Maximizing Your IRA | |

| Displaced Moving Averages | |

| Creating a Gaps Trading System | |

| Combining Candlesticks and Price Patterns | |

| Analyzing Heiken-Ashi Candlesticks | |

| What is Indicator Piling and How to Avoid it | |

| Introduction to Elliott Wave Analysis | |

| Building Trading Systems with Donchian Channels – Round Two | |

| Setting Stop Losses on Options | |

| Exploring the Moving Average Convergence/Divergence (MACD) | |

| When Should I Adjust My Oscillators Settings? | |

| How to Interpret Relative Strength | |

| Selling Put Options as an Income Strategy | |

| Understanding Investor Psychology and Using it to Your Advantage | |

| Navigating Choppy Markets | |

| Using Comparative Relative Strength as a Forecasting Tool | |

| Using the Parabolic SAR to Identify Pullbacks | |

| When to Straddle and When to Strangle | |

| Contrarian Investing Strategies | |

| Using the VIX to Build a Leveraged ETF Trading System | |

| Identifying the Pump-and-Dump Pattern in Penny Stocks | |

| How to Determine if Money is Flowing In or Out of Stocks | |

| A Closer Look at Flag Patterns | |

| The Fundamentals of Covered Calls | |

| Identifying an Option That Is Expensive Relative to Historical Prices | |

| Ramping Up with Call Ratio Backspreads | |

| Timing Your Trades with Keltner Channels | |

| Five Red Flags to Look for in Annual and Quarterly Reports | |

| Detecting Weakening Fundamental Strength | |

| Using Probability Cones in Your Option Trading | |

| The Pros and Cons of Scaling In to and Out of Trades | |

| Timing Trades with the Head and Shoulders Pattern | |

| Understanding Ichimoku Clouds | |

| Screening for Bullish Reversal Patterns | |

| Timing Your Trades with Aroon Indicators | |

| Understanding Preferred Stocks | |

| The Impact of Currency Rates on Stock Prices | |

| Analyzing Market Breadth Indicators | |

| Comparing the 3-10 Oscillator and the MACD | |

| Setting Price Targets for Technical Divergences | |

| Building a Long-Short Portfolio Strategy | |

| Digging in to ScottradeELITE’s Recognia Tools | |

| When to Use Fast vs. Slow Stochastics | |

| Setting Price Targets with Fibonacci Analysis | |

| Trading and Identifying Pennants and Flags | |

| Conquer Your Emotions and Improve Your Trading Discipline | |

| Analyzing Auto Regression Channels and Trend Lines | |

| Using the Balance Sheet to Understand and Find Value Stocks | |

| Exploring Investing Methodologies: CAN SLIM | |

| Identifying Swing Highs and Swing Lows for Trade Entries | |

| Using Andrew’s Pitchfork to Time Trades | |

| Trading the Gaps | |

| Exploring the Fama-French Three-Factor Portfolio Model | |

| Trading with Speed Lines and Fibonacci Fans | |

| Using Commodities and Currencies to Forecast Stock Prices | |

| Being Right and Still Losing Money in an Option Trade | |

| Watching Options for Stock Market Clues | |

| Trading Strategies for a Bear Market | |

| Identifying Problems on the Cash Flow Statement | |

| Identifying Lows and Highs | |

| Trading Pre-Market and After-Hours | |

| Bollinger Bands, BandWidth and %b | |

| Basic Strategies for Buying Puts | |

| Trading and Identifying Island Reversals | |

| Sell in May and Go Away? | |

| The Pros and Cons of Moving-Average-Crossover Systems | |

| The Cup and Handle Technical Pattern | |

| Insider Trading – Does it Matter? | |

| Identifying and Trading Reversal Patterns | |

| Finding Support and Resistance with Volume by Price | |

| Position Sizing Like the Professionals | |

| Trading and Screening for Pipe-Top and Horn-Top Patterns | |

| Vega: Understanding the Most Misunderstood Option Greek | |

| Get Started with Charting Basics | |

| Stock Splits as a Forecasting Tool | |

| Identify Problems Early with the Cash Conversion Cycle | |

| Understanding the Most Important U.S. Economic Announcements | |

| Identifying and Trading Potential Short Squeezes | |

| Improving Candlestick Analysis | |

| Trading Early Signals from Broadening Patterns | |

| Trading “Covered Calls on LEAPS” | |

| Dissecting the Money Flow Index (MFI) | |

| The Ins and Outs of the Gold Market and Gold ETFs | |

| Identifying Accounting Shenanigans in the Financial Statements | |

| Identifying Price Targets with the RSI | |

| Fine Tuning the Volume by Price Indicator | |

| When to Use Leveraged ETNs and When to Avoid Them | |

| Using the ‘Awesome’ Oscillator to Identify Trades | |

| Sector Rotation and the Business Cycle | |

| Adjusting Expectations with the Average Directional Index (ADX) | |

| Combining Candlesticks and Price Patterns | |

| When Straddles/Strangles Make Sense and When They Don’t | |

| The Magic of Multiple Charting Time Frames | |

| Choosing the Best Oscillating Indicator for Your Charts | |

| Reading the Commitment of Traders (COT) Report | |

| Creating a Gaps Trading System | |

| Maximizing Your IRA | |

| The 56-Week Long-term Capital Gains Cycle | |

| Setting Up Trades with Candlestick Continuation Patterns | |

| Does Volume Lead the Price? | |

| Analyzing Heiken-Ashi Candlesticks | |

| Tracking Risk Aversion with the VIX, SKEW and Margin Debt | |

| When Long Option Spreads Make Sense (and when they don’t) | |

| Understanding Investor Psychology and Using It to Your Advantage | |

| Setting Stop Losses on Options | |

| Trading Divergent Bars and Angulation | |

| Detecting Weakening Fundamental Strength | |

| When Should I Adjust My Oscillators Settings? | |

| How to Interpret Relative Strength | |

| Building Trading Systems with Donchian Channels | |

| What is Indicator Piling and How to Avoid It | |

| How to Build and Maintain a Watch List | |

| Navigating Choppy Markets | |

| Using the Balance Sheet to Understand and Find Value Stocks | |

| Using Comparative Relative Strength as a Forecasting Tool | |

| When to Straddle and When to Strangle | |

| Using the VWAP to Improve Trading | |

| The Fundamentals of Covered Calls | |

| Understanding Ichimoku Clouds | |

| How to Determine if Money is Flowing In or Out of Stocks | |

| A Closer Look at Flag Patterns | |

| The Ins and Outs of Pairs Trading | |

| Insider Trading: Does it Matter? | |

| Ramping Up with Call Ratio Backspreads | |

| Timing Your Trades With Keltner Channels | |

| Five Red Flags to Look for in Annual and Quarterly Reports | |

| The Impact of Currency Rates on Stock Prices | |

| Using Probability Cones in Your Option Trading | |

| The Pros and Cons of Scaling In to and Out of Trades | |

| Understanding Preferred Stocks | |

| The Basics of Buying Call Options | |

| Searching for Reversal Patterns | |

| Trading with the Aroon Indicator | |

| Setting Price Targets for Technical Divergences | |

| Using Andrew’s Pitchfork to Time Trades | |

| Analyzing Market Breadth Indicators | |

| Comparing the 3/10 Oscillator and the MACD | |

| Building a Long-Short Portfolio Strategy | |

| Advanced Options: Trading Iron Condors | |

| Digging in to ScottradeELITE’s Recognia Tools | |

| When to Use Fast vs. Slow Stochastics | |

| Basic Strategies for Buying Puts | |

| Trading and Identifying Pennants and Flags | |

| Conquer Your Emotions and Improve Your Trading Discipline | |

| Analyzing Auto Regression Channels and Trend Lines | |

| Creating Price Targets from Candlestick Patterns | |

| The Cup and Handle Technical Pattern | |

| Exploring Investing Methodologies: CAN SLIM | |

| Identifying Swing Highs and Swing Lows for Trade Entries | |

| Trading and Identifying Island Reversals | |

| Trading the Gaps | |

| Exploring the Fama-French Three-Factor Portfolio Model | |

| Trading with Speed Lines and Fibonacci Fans | |

| Introduction to Elliott Wave Analysis | |

| Can Penny Stocks Produce Dollar Profits? | |

| Watching Options for Stock Market Clues | |

| The Ups and Downs of the Business Cycle | |

| Position Sizing Like the Professionals | |

| Basic Strategies for Buying Puts | |

| Trading Pre-Market and After-Hours | |

| Bollinger Bands, BandWidth and %B | |

| Identifying Lows and Highs | |

| Trading and Screening for Pipe-Top and Horn-Top Patterns | |

| Sell in May and Go Away? | |

| The Pros and Cons of Moving-Average-Crossover Systems | |

| Identifying Problems on the Cash Flow Statement | |

| Setting Price Targets with Diamond Tops and Bottoms | |

| Vega: A Deep Dive into this Option Greek | |

| Identifying and Trading Reversal Patterns | |

| Identify Problems Early with the Cash Conversion Cycle | |

| Being Right and Still Losing Money in an Option Trade | |

| Understanding the Most Important U.S. Economic Announcements | |

| Get Started with Charting Basics | |

| Forecasting an Option’s Future Price | |

| Does Volume Lead the Price? | |

| Identifying and Trading Potential Short Squeezes | |

| Creating a Rapid Rebalancing System | |

| Using Bollinger Bands to Time Your Trades | |

| Trading Early Signals from Broadening Patterns | |

| Trading “Covered Calls on LEAPS” | |

| Finding Support and Resistance with Volume by Price | |

| Using Commodities and Currencies to Help Forecast Stock Prices | |

| Real Estate Investing Through the Stock Market | |

| Analyzing Multiple Time Frames | |

| Dissecting the Money Flow Index (MFI) | |

| Using the VIX to Build a Leveraged ETF Trading System | |

| Identifying a Market Bottom | |

| Supercharging Your IRA | |

| Exploring the Pros and Cons of Different Oscillators | |

| Using the Financials to Help Justify a Stock’s Price | |

| Bonds vs. Bond ETFs – What You Don’t Know Can Hurt You | |

| How the Business Cycle Affects Various Market Sectors | |

| How the Average Directional Index (ADX) Can Change Your Analysis | |

| When Straddles/Strangles Make Sense and When They Don’t | |

| When Long Option Spreads Make Sense and When They Don’t | |

| Using the RSI to Establish Price Objectives | |

| The 56-Week Long-term Capital Gains Cycle | |

| Fibonacci Arcs | |

| Combining Candlesticks and Price Patterns | |

| Analyzing Heiken-Ashi Candlesticks | |

| What is Indicator Piling and How to Avoid it | |

| Setting Up Trades with Candlestick Continuation Patterns | |

| Reading the Commitment of Traders (COT) Report | |

| Setting Stop Losses on Options | |

| The Fundamentals of Covered Calls | |

| Identifying an Option that is Expensive Relative to Historical Prices | |

| When Should I Adjust My Oscillators Settings? | |

| Contrarian Investing Strategies | |

| Five Red Flags to Look for in Annual and Quarterly Reports | |

| Insider Trading: Does it Matter? | |

| How to Build and Maintain a Watch List | |

| A Closer Look at Flag Patterns | |

| Determining the Strengths and Weaknesses between ETFs | |

| Using Andrew’s Pitchfork to Time Trades | |

| When to Straddle and When to Strangle | |

| How to Interpret Relative Strength | |

| Identifying Accounting Shenanigans in the Financial Statements | |

| Understanding Preferred Stocks | |

| How to Determine if Money is Flowing In or Out of Stocks | |

| Navigating Choppy Markets | |

| Setting Price Targets for Technical Divergences | |

| The Impact of Currency Rates on Stock Prices | |

| Ramping Up with Call Ratio Backspreads | |

| The Pros and Cons of Scaling Into and Out of Trades | |

| Trading and Identifying Island Reversals | |

| Using Probability Cones in Your Option Trading | |

| Timing Your Trades with Short-Term Aroon Indicators | |

| Building a Long-Short Portfolio Strategy | |

| Trading the Gaps | |

| Screening for Bullish Reversal Patterns | |

| Comparing the 3-10 Oscillator and the MACD | |

| The Basics of Buying Call Options | |

| The Cup and Handle Technical Pattern | |

| Analyzing Market Breadth Indicators | |

| Using Fast vs. Slow Stochastics | |

| Use the Big-Three Financial Statements to search for Stocks | |

| Increasing Your Strategic Flexibility with Credit Spreads | |

| Digging in to ScottradeELITE’s Recognia Tools | |

| Analyzing Regression Channels and Trend Lines | |

| Using One Value Ratio to Evaluate a Stock’s Fundamentals | |

| Using Fibonacci Projections to Identify Profit Targets | |

| Conquer Your Emotions To Help Improve Your Trading Discipline | |

| Identifying Swing Highs and Swing Lows for Trade Entries | |

| When Volume Matters and When it Doesn’t | |

| Creating Price Targets from Candlestick Patterns | |

| Exploring Investing Methodologies: CAN SLIM | |

| Trading with Speed Lines and Fibonacci Fans | |

| Position Sizing Like the Professionals | |

| Advanced Analysis of the VIX | |

| Exploring the Fama-French Three-Factor Portfolio Model | |

| The Ups and Downs of the Business Cycle | |

| Basic Strategies for Buying Puts | |

| Identifying an Option that is Expensive Relative to Historical Prices | |

| Watching Options for Stock Market Clues | |

| Option Strategies with Mini and Weekly Options | |

| Learn Why All REITS are Not Created Equal | |

| Identifying the Trend with Donchian Channels | |

| Trading Pre-Market and After-Hours | |

| Bollinger Bands, Bandwidth and %b | |

| Using Commodities to Forecast Stock Prices | |

| Learn About the Pipe-Top and Horn-Top Patterns | |

| Sell in May and Go Away? | |

| The Pros and Cons of Moving-Average-Crossover Systems | |

| Bonds vs. Bond ETFs: What You Don’t Know Can Hurt You | |

| Setting Price Targets with Diamond Tops and Bottoms | |

| Vega: A Deep Dive into this Important Option Greek | |

| Identifying and Trading Reversal Patterns | |

| Identifying Problems on the Cash Flow Statement | |

| Identifying Lows and Highs | |

| Understanding the Most Important U.S. Economic Announcements | |

| Get Started with Charting Basics | |

| Identifying and Trading Short Squeezes | |

| Currency ETFs and ETNs: Trading in the World’s Largest Market | |

| Trading “Covered Calls on LEAPS” | |

| Creating a Rapid Rebalancing System | |

| Introduction to Elliott Wave Analysis | |

| The Simple and Complex World of Dividends | |

| Option Straddles and Strangles | |

| Finding Support and Resistance with Volume by Price | |

| Forecasting an Option’s Future Price | |

| Understanding Investor Psychology and Using it to Your Advantage | |

| Analyzing Multiple Time Frames | |

| How the Average Directional Index (ADX) Can Change Your Analysis | |

| Using the VIX to Build a Leveraged ETF Trading System | |

| The Ins and Outs of Pairs Trading | |

| Identifying a Market Bottom | |

| Digging Into the Money Flow Index | |

| Using the Financials to Understand a Stock’s Price | |

| Trading Early Signals from Broadening Patterns | |

| Consulting the Analysts and Insiders | |

| Dissecting the Relative Strength Index (RSI) | |

| The Impact of Currency Rates on Stock Prices | |

| Setting Up Trades with Candlestick Continuation Patterns | |

| Using the Options Tools in ScottradeELITE | |

| Using Bollinger Bands® for Swing Trading | |

| Can Penny Stocks Produce Dollar Profits? | |

| Selling Cash-Secured puts vs. Writing Covered Calls | |

| When Should I Adjust My Oscillators Settings? | |

| Trading The Gaps | |

| Identifying Accounting Shenanigans in the Financial Statements | |

| Position Size like the Professionals | |

| Advanced Analysis of the VIX | |

| Identifying the Trend with Donchian Channels | |

| Contrarian Investing Strategies | |

| Combining Price and Volume in the Money Flow Index | |

| Trading and Identifying Pennants and Flags | |

| Matching Candlestick Patterns and Pivots for Swing Trades | |

| Setting Stop Losses on Options | |

| Ramping up with Ratio Call Backspreads | |

| Insider Trading – Does it Matter? | |

| Use the Big-Three Financial Statements to search for Stocks | |

| How to Tell Which Way Money is Flowing in the Markets | |

| How to Build and Maintain a Watch List | |

| Exploring the Moving Average Convergence/Divergence (MACD) | |

| Using Multiple Chart Time Frames for Swing Trading | |

| When to Straddle and When to Strangle | |

| Confirming Price Moves with Volume | |

| How to Read and Use an Earnings Report | |

| Advanced Butterfly Option Strategies | |

| The Pros and Cons of Scaling In to and Out of Trades | |

| Using Probability Cones in Your Option Trading | |

| Forecasting an Option’s Future Price | |

| Learn About the Pipe-Top and Horn-Top Patterns | |

| Fine-Tuning Trailing Stop Losses | |

| Protect Your Stock from Wall Street Bears with a Collar | |

| Building Technical Trading Systems | |

| Using the Income Statement to Understand Revenue, Earnings, and Value | |

| Confirming Bullish Entries with Swing Lows | |

| Watching Options for Stock Market Clues | |

| Using Fibonacci Projections to Help Identify Profit Targets | |

| Using Sector Rotation to Evaluate the Business Cycle | |

| Screening for Bullish Reversal Patterns | |

| The Ups and Downs of the Business Cycle | |

| Advanced Options: Trading Iron Condors | |

| Evaluating the Quality of an ETF | |

| Analyzing Market Breadth Indicators | |

| Identifying and Trading Short Squeezes | |

| Candlestick Continuation Patterns…Continued | |

| The Cup and Handle Technical Pattern | |

| Screening for Bullish Stocks Experiencing Bearish Pullbacks | |

| Setting Up Trades with Candlestick Continuation Patterns | |

| Finding the Top-Performing Stocks in Each Industry | |

| Conquer Your Emotions and Improve Your Trading Discipline | |

| Trading with Speed Lines and Fibonacci Fans | |

| Aroon Techniques for Early Trend Signals | |

| Searching for Stocks Likely to Breakout | |

| Exploring Investing Methodologies: CAN SLIM | |

| Digging in to the Recognia Tool on ScottradeELITE | |

| Strategies for Pairs Trading | |

| Creating Price Targets from Candlestick Patterns | |

| Bridging the Gap between Stocks and Options with LEAPS | |

| Option Strategies with Mini and Weekly Options | |

| Using the Financial Statements to Justify a Stock’s Ratios | |

| Trade Setups with the RSI Indicator | |

| Identifying Swing Highs and Swing Lows for Trade Entries | |

| Setting Stop Losses on Option Trades | |

| Identifying Problems on the Cash Flow Statement | |

| Applying Trend Lines to Technical Indicators | |

| Selling Puts vs. Writing Covered Calls | |

| Sell in May and Go Away? | |

| Consider Using Implied Volatility and the VIX to Help Forecast the Market | |

| Position Sizing Like the Professionals | |

| Trading Pre-Market and After-Hours | |

| Vega: A Deep Dive into this Important Option Greek | |

| Using Commodities to Forecast Stock Prices | |

| Out of the Money Short Call Spreads | |

| Understanding Price Gaps and What Causes Them | |

| Staying Bullish with Vertical Put Spreads | |

| The Simple and Complex World of Dividends | |

| Using Comparative Relative Strength to Time Trade Entries and Exits | |

| Identifying and Trading Continuation Patterns | |

| Understanding the Most Important U.S. Economic Announcements | |

| Use Fibonacci Extensions and Projections to Create Price Targets | |

| Basic Strategies for Buying Puts | |

| Analyzing Multiple Time Frames | |

| Identifying and Trading Reversal Patterns | |

| How Fundamental Analysis Affects the Price Trend | |

| Strategies for Dealing with Investor Psychology | |

| Intermarket Analysis in an Age of QE | |

| How the Average Directional Index (ADI) Can Change Your Analysis | |

| Introduction to Elliott Wave Analysis | |

| Reading the Commitment of Traders (COT) Report | |

| Finding Support and Resistance with Volume by Price | |

| Explore Using Bollinger Bands® for Swing Trading | |

| Learn About the Pipe-Top and Horn-Top Patterns | |

| Strategies for Choosing the Right Strike Price and Expiration Date | |

| How the Business Cycle Affects Various Market Sectors | |

| Creating Synthetic Calls and Puts | |

| Can Penny Stocks Produce Dollar Profits? | |

| Explore Timing Short Term Trades with Engulfing Patterns | |

| Using the RSI to Establish Price Objectives | |

| Condors vs. Butterflies | |

| Learn Why All REITS are Not Created Equal | |

| Learn More about Leveraged ETNs | |

| Strategies for Trading “Covered Calls on LEAPS” or Diagonal Spreads | |

| When Should I Adjust My Oscillators Settings? | |

| Explore Call Ratio Backspreads | |

| Building a Diversified Portfolio | |

| Learn about Credits Spreads and their Potential to Generate Income | |

| Creating a Pivot Point Trading System | |

| Timing Your Trades with Keltner Channels | |

| Identifying Breakouts in Small Momentum Stocks | |

| Entering Trades on Price Gaps | |

| Buying Time with Calendar Spreads | |

| Using Commodity Prices to Analyze Commodity Stocks | |

| Option Strategies with Mini and Weekly Options | |

| Contrarian Investing Strategies | |

| Utilizing Put Options for Bearish Trades | |

| Using the Balance Sheet to Find Value Stocks | |

| Trading Strategies for Weekly Options | |

| What Sector Rotation Could Tell You About the Trend | |

| What Volume Might Tell Us About Support and Resistance | |

| Price Moves and Volume | |

| Confirming Price Moves with Technical Indicators | |

| Dividends or Share Buybacks – Which is Better? | |

| Learn more about Selling Puts | |

| Identifying Accounting Shenanigans in the Financial Statements | |

| Identifying and Trading Price Breakouts | |

| Using Probability Cones and Other ScottradeELITE Tools | |

| Identifying and Trading Bar Chart Patterns | |

| Using Trailing Stop-on-Quote Orders | |

| Determining Risk/Reward Ratios in Your Investing Strategies | |

| Learn More About the Collar Option Strategy | |

| Learn More about Option Straddles for Long Term Traders | |

| Learn About Using Swing Highs and Swing Lows for Trade Entries | |

| Is Your ETF Everything it’s Cracked Up to Be? | |

| Matching Candlestick Patterns and Pivots for Swing Trades | |

| Introduction to Elliott Wave Analysis | |

| Identifying and Trading Short Squeezes | |

| Analyzing Options Data to Gauge Market Sentiment | |

| Introduction to Trading Mini Options | |

| The Basics of Buying Call Options | |

| Tapping Into the Business Cycle | |

| Setting Stop-on-Quote and Target Levels with Candlestick Reversal Patterns | |

| Learn about Credits Spreads and their Potential to Generate Income | |

| Building Long-Short Strategies | |

| How to Draw Your Own Fibonacci Fan Lines | |

| Using Fibonacci Projections to Identify Profit Targets | |

| Conquer Your Emotions and Improve Your Trading Discipline | |

| Using the Cash Flow Statement to Find Growth Stocks | |

| Legging Into and Out of Vertical Spreads | |

| Informing Your Stock Trades with Intermarket Analysis | |

| How to Use TRIN and Advance-Decline Indicators | |

| Consider Giving Your Options Trades Time to Develop with LEAPS | |

| Using Valuation Ratios to Find Stocks | |

| Digging into CAN SLIM | |

| Trend Trading With Donchian Channels | |

| Timing Covered Call Trades | |

| Position Sizing for Short-Term Traders | |

| Aroon Techniques for Early Trend Signals | |

| Learn about Using the Big-Three Financial Statements to Search for Stocks | |

| Intro to Options Trading | |

| Explore Option Strategies with Mini and Weekly Options | |

| Explore Using Bollinger Bands® for Swing Trading | |

| Reading the Commitment of Traders (COT) Report | |

| Setting Stop Losses on Option Trades | |

| Trading Pre-Market and After-Hours | |

| Sell in May and Go Away? | |

| Understanding Price Gaps and What Causes Them | |

| Buying Time with Calendar Spreads | |

| Curious About Penny Stocks? | |

| Unlocking the Power of the Commodity Channel Index (CCI) | |

| Learn How to Use Protective Puts in a Bear Market | |

| Staying Bullish with Vertical Put Spreads | |

| Portfolio Management with Sector Rotation | |

| Timing Your Trades with Aroon Indicators | |

| Understanding Candlestick Reversal Patterns | |

| Conducting Technical Analysis on Your Technical Indicators | |

| Using Moving Averages to Identify Support and Resistance Levels | |

| Expanding Your Toolkit with Bull-Call Spreads | |

| Explore Candlestick Continuation Patterns | |

| Vega: A Deep Dive into this Important Option Greek | |

| Using Options to Construct Synthetic Long or Short Positions | |

| Finding Trading Signals with the Relative Strength Index (RSI) | |

| Explore Timing Trade Entries and Exits with the Ultimate Oscillator | |

| Do Options and Earnings Announcements Mix? | |

| Learn When to Change Indicator Parameters – and When Not To | |

| Buy Stocks at a Discount by Selling Puts | |

| Explore Advanced Butterfly Option Strategies | |

| Pairing Stocks with ETFs for Protection | |

| Learn How to Trade Broadening Top and Bottom Patterns | |

| Gauging Investor Sentiment with Market Breadth Indicators | |

| Identifying and Trading Potential Short Squeezes | |

| Learn Why All REITS are Not Created Equal | |

| Learn How to Create Price Projections Based on Fibonacci Ratios | |

| Learn About Integrating the Average Directional Index (ADX) Into Your Analysis | |

| Learn When to Combine Indicators to Avoid Indicator-Piling | |

| How Options React Around Earnings Announcements | |

| Learn Pivot Point Trading Strategies | |

| What Volume Can Tell Us About Support and Resistance | |

| Consider Using Implied Volatility and the VIX to Help Forecast the Market | |

| Help Supercharging Your IRA | |

| Advanced Options: Trading Iron Condors | |

| Determining Trends with the Linear Regression Line | |

| The Cup and Handle Technical Pattern | |

| Trading with the Chaikins Volatility Indicator | |

| Silver and Gold – Learn which may be Better? | |

| Using the Parabolic SAR to Identify Pullbacks | |

| Learn About Timing Trades with the Head and Shoulders Pattern | |

| Taking Advantage of Large Price Moves with Backspreads | |

| Using Price Gaps to Enter or Exit Trades | |

| Basic Candlestick Patterns | |

| Taking Advantage of Small Price Moves with Ratio Spreads | |

| Building Trading Strategies with Keltner Channels | |

| Getting an Edge with Obscure Economic Indicators | |

| Using Fibonacci Time Zones to Confirm a Trend Reversal | |

| Inflation Investing with TIPS, I Bonds and More | |

| Understanding Candlestick Reversal Patterns – Part Two | |

| What to Look for in a Good Mutual Fund | |

| Using Bearish Markets to Find Bullish Trades | |

| Pros and Cons of Almanac Investing | |

| Using Bollinger Bands® to Time Your Trades | |

| Trading Strategy Part 4: Salvaging a Bad Trade with Call Options | |

| Trading Strategy Part 3: Knowing When to Hold ‘Em and When to Fold ‘Em | |

| Trading Strategy Part 2: Protecting Your Profits and Managing Your Risk | |

| Trading Strategy Part 1: Identifying Technical Divergences | |

| Mastering Stop Losses | |

| Trading the Most Important U.S. Economic Announcements | |

| Using Standard & Poor’s Analysis in Your Research | |

| Strategies for Trading Diagonal Spreads | |

| Protecting Stocks You Want to Hold with Collars | |

| Searching for Stocks Likely to Break Out | |

| Scaling Into and Out of Your Trades | |

| Trading Strategies for Weekly Options | |

| Understanding Leveraged and Inverse ETFs | |

| Penny Stocks – Are They Worth the Effort? | |

| Using the Money Flow Index in your Trading | |

| How Gold, Silver, Copper and other Metals can be Traded through Stocks | |

| Analyzing Options Data to Gauge Market Sentiment | |

| Timing Trades with the Commodity Channel Index (CCI) | |

| Timing Trades with the Williams %R indicator | |

| Using Currency ETFs and Currency Index Options | |

| Position Sizing – Staying Consistent as a Short Term Trader | |

| Selling Puts or Writing Covered Calls | |

| Understanding Forward Earnings Estimates and Trends | |

| Option Straddles and Strangles | |

| How Credit Spreads Work | |

| Position Sizing and Diversification for Long Term Investors | |

| Using Fibonacci Fan Lines | |

| Using Price Patterns to Time Trade Exits | |

| Searching for Stocks Likely to Breakout | |

| Trading LEAPS and Other Long Term Options | |

| Bonds vs. Bond ETFs – What You Don’t Know Can Hurt You | |

| Trading Like a Turtle – Momentum Trading in Today’s Market | |

| Looking for Technical Confirmation without “Indicator Piling” | |

| Timing a Covered Call Trade | |

| Timing Trade Entries and Exits Based on Support and Resistance | |

| How to Choose Between Front-Month and Back-Month Expiration Dates | |

| The Cup and Handle Technical Pattern | |

| The Party May be Over when Reversal Patterns Appear | |

| Using Moving Averages to Identify Support and Resistance Levels | |

| Navigating the First and Last Hours of the Trading Day | |

| How Futures Backed ETFs Work | |

| Using Bollinger Bands® to Time Your Trades | |

| How to Choose Between Out, In, or At the Money Strike Prices | |

| Options Mastery: Buying Low Volatility and Selling High Volatility | |

| Fibonacci Support and Resistance | |

| Letting Trades Run with Continuation Patterns | |

| Using the Stochastics Oscillator to Time Trades | |

| Mastering Options with Calendar Spreads | |

| Advanced Diagonal Spread Option Strategies | |

| Timing Trades with the Commodity Channel Index (CCI) | |

| Using the Income Statement to Understand Revenue, Earnings, and Value | |

| Understanding the Most Important U.S. Economic Announcements | |

| Mastering Options with Bull-Put Spreads | |

| Learning to Use Pivot Points in Swing Trades | |

| Exploring the Relative Strength Index (RSI) | |

| Trading the DCB Technical Pattern | |

| Option Greeks Basics | |

| Candlestick Reversal Patterns | |

| Currency ETFs and ETNs: Trading in the World’s Largest Market | |

| Using Technical Patterns to Create Price Targets | |

| Trading Bull-Call Spreads | |

| Understanding Market Fear and the VIX | |

| Exploring the MACD Technical Indicator | |

| Relative Strength and Sector Rotation | |

| Buying Stocks by Selling Puts | |

| Emerging Markets Stocks and ETFs | |

| Learn more about Covered Calls | |

| Using the Balance Sheet to Help Understand and Find Value-Stocks | |

| Candlestick Continuation Patterns | |

| Trading with the Insiders | |

| The Head and Shoulders Pattern: A Deep Dive Into Reversal Patterns | |

| Plunging into the Real Estate Market with REITs | |

| All that Glitters… How the Gold Stock and ETF Markets Work | |

| Playing Both Sides with Pairs Trading | |

| Commodity ETFs: The Good, the Bad, and the Ugly | |

| Bond Basics: What are Bonds and How do They Fit in Your Portfolio? | |

| Understanding and Using Bollinger Bands® |

You will learn how to build out a core portfolio with equities and ETFs and when to seek out strategic alternatives to protect and grow your portfolio.

What's included: eight comprehensive courses that cover everything from equities to dividends to basic options strategies to help you strategically extend your base portfolio.

The team at Learning Markets has been developing online course content for investors for well over 15 years. Thousands of investors have watched our videos, submitted assignments and participated in webinars. We've been able to fine-tune the course experience so that investors can learn more, by applying skills in a supportive environment that encourages questions.

The biggest challenge most investors face, once they learn how to invest, is finding good stocks. Use our fundamental stock screening tool to get great stock investing ideas every day.

With more than a dozen pre-built searches we can help you find stocks for any purpose, whether it's "Stocks that do well with rising interest rates," or "Buyback Kings," you can get ideas with the push of a button.

More than 600 webinars show you how to invest using a variety of investing techniques. All 60-minute recorded webinars are searchable by keyword. Learn about techniques such as:

John Jagerson is a CFA® and CMT charter holder and a founder of Learning Markets, which provides analysis and education for individual and professional investors. He is an author or co-author of five books on investing, currencies, bonds, and stocks. John has appeared in outlets like Forbes.com, BBC Radio, Nasdaq.com, and CBS for his financial strategy expertise. After graduating with a B.S. in Business from Utah Valley University, John completed the PLD program at Harvard Business School. Once the markets close each day, he can be found back on his mountain bike or in his running shoes on the trails of the Wasatch Mountains near his home.

S. Wade Hansen is a Chartered Market Technician (CMT) and a founder and managing partner at Learning Markets. He provides stock and option analysis for Investor Place Media. Wade is the co-author of All About Forex Trading (McGraw-Hill, 2011), All About Investing in Gold (McGraw-Hill, ) and Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies (McGraw-Hill, 2006). He also has written for Yahoo! Finance, Forbes.com and Nasdaq.com. He has an MBA from the University of Utah and was a managing partner at Ouroboros Capital Management.